Amidst widespread dissent, the Iranian government has opted to cover its budget deficit predominantly through heightened taxation, sparking significant concern and opposition among its citizens.

At the heart of this controversy is the Majlis, Iran’s Parliament, whose members initially opposed the regime’s budget bill. The state-run Mashregh news, on December 20, disclosed that the reasons for this opposition included fears of public backlash against the increased taxation, perceived as unjust. The bill was criticized for its high deficit, the excessive tax burden it imposed, and the lack of provisions for equalizing retired workers’ salaries.

However, within days, these objections seemed to dissolve, with the Majlis voting in favor of the budget’s general aspects. This change of heart was attributed to a perceived lack of alternatives but to levy taxes on the populace. This decision came against the backdrop of a reported decrease in oil revenues, as noted in a December 25 report by IRNA news agency.

Yet, this increase in tax revenues is not a recent phenomenon. As Tabnak newspaper highlighted on December 18, there has been a consistent growth in tax revenues since 2020, with the 2024 figures following a similar upward trend.

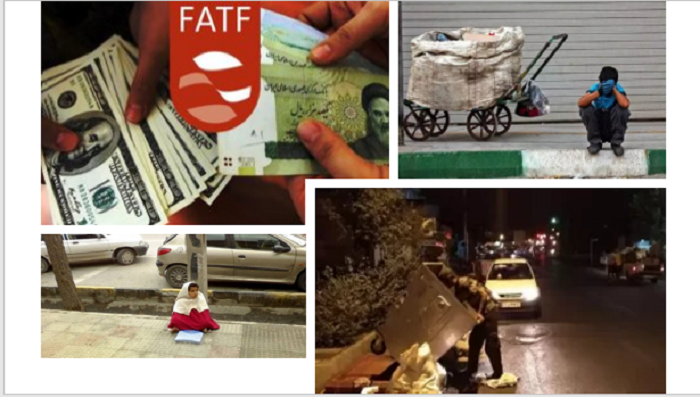

The impact of these fiscal policies is particularly severe on the poorer segments of society. Experts have pointed out that the combination of a 50% increase in taxes and an over 50% inflation rate could devastate low-income families, even if their wages were to increase by 20%. Donyaye Eghtesad newspaper, on December 18, illustrated this plight with an example of an employee whose purchasing power dramatically declined from 2022 to 2024, despite wage increases.

Economist Hossein Raghfar, quoted by ILNA news agency on December 4, criticized the government’s reluctance to impose taxes on state-owned companies. He argued that this reluctance, justified by the potential impact on market competitiveness, places an undue burden on ordinary citizens.

This increasing tax burden has even extended to the gold market, traditionally a haven for Iranian investors. After the imposition of taxes on gold transaction profits, many traders have reportedly expressed their dissatisfaction, as reported by Donya-ye Eqtesad on December 28. They argue that the increase in their assets, a result of inflation, should not be considered profit for tax purposes.

MEK Iran (follow us on Twitter and Facebook), Maryam Rajavi’s on her site, Twitter & Facebook, NCRI (Twitter & Facebook), and People’s Mojahedin Organization of Iran – MEK IRAN – YouTu